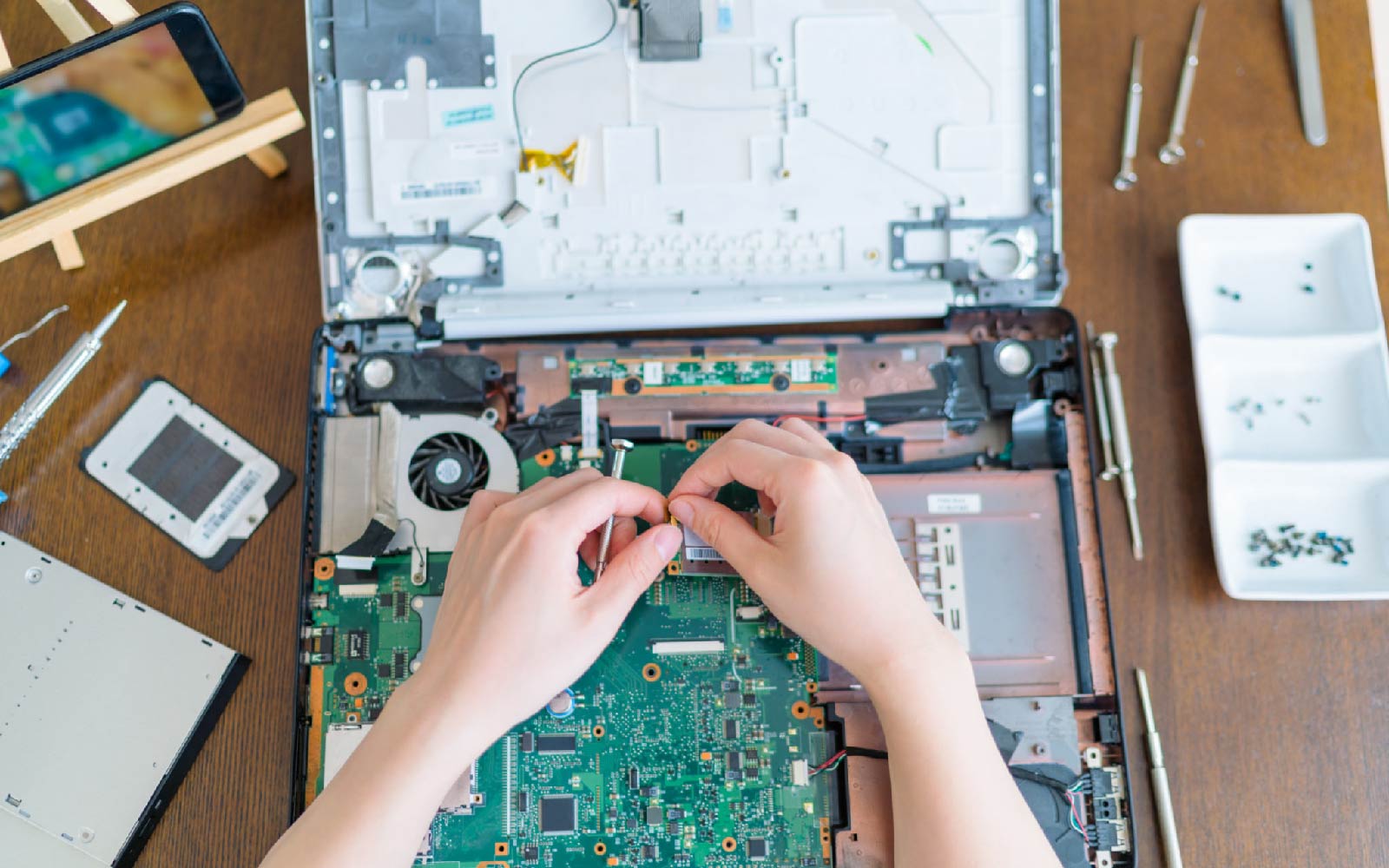

People often inquire, “Can I claim laptop repair on my taxes?” in response to this query.

Make sure you read this article in its entirety before seeking a tax professional in your area to deduct the cost of repairing your laptop from your taxes.

People in the United States who are self-employed have traditionally been allowed to claim tax deductions for the cost of company assets and equipment if they are utilizing such assets and equipment only to earn revenue. However, in recent years the Internal Revenue Service (IRS) has started to crack down on individuals who claim tax deductions for assets that are utilized both personally and in the role of their businesses.

How the Tax is Determined

The amount of tax added to your purchase depends on several criteria, including those listed below:

- The identity of the business from which you purchased the item or service

- The nature of the item or service purchased

- The time and location of delivery

- The shipment or delivery address for your order

These parameters can change between when you make an order and when your shipping is finished. As a direct consequence of this, the tax computed for your order may differ. When an order is confirmed, we will provide an “Estimated Tax” that will be collected when the customer checks out. When your purchase is finished being processed and approved, the tax amounts given as estimates may subsequently be adjusted accordingly.

Your order will be subject to a tax rate equal to the sum of the state and local tax rates that apply to the location where your order is delivered to or fulfilled. If you reside in a state that does not involve a sales tax, you may still see tax assessed on your purchase if transported to a condition requiring a sales tax.

Additionally, the tax rates that are applied to your transaction may be different for various reasons, such as when the product is being sent to a private house as opposed to an address for a place of business. In most cases, the total selling price of an item will include item-level shipping and handling fees, item-level discounts, and gift-wrapping fees. When applied at the level of an order, these costs may be broken down and applied to each item that makes up an order.

If you purchase anything from Amazon.com and have it sent to a nation outside the United States, you may be subject to the tax rate in effect in that country.

Note:

- No tax is applied when buying gift cards; however, transactions made using gift cards may be subject to tax.

- Books leased from Warehouse Deals and mailed to Delaware are taxed.

Laptops are costly, so any assistance we may get in paying for them would be much appreciated. While the worldwide pandemic has significantly altered how we live and work, how we file tax returns has remained primarily unchanged.

Can I Claim Laptop Repair On My Taxes? Here is what you need to remember!

Keep a ledger

To claim a laptop as a work-related cost, you must maintain a few records. The first and most evident is the item’s receipt as evidence of purchase and the date of purchase.

The second and much less visible item you’ll need to maintain is a four-week log of its job usage. It requires to include the date, the time you began using the laptop for work, the actions you performed for such job, and the time you finished, taking into account break intervals.

Determine which sort of claim is optimal for you

There are several methods to claim work-related costs. To submit a claim for the entire amount, the item in issue must cost less than $300, eliminating the vast majority of computers.

If the laptop or tablet costs $300 or more, you must deduct the expense, the IRS-established practical life for computers and tablets over two years. In the first year, you may only claim for the time you held the laptop; the later in the year you acquired it, the lesser your claim will be.

Do not assert something you cannot substantiate

It’s all well to purchase a sleek new laptop and claim you use it for business, but if the IRS senses anything fishy in your claim, the burden of proof ultimately falls on you. If you are detected, you might face pretty severe criminal charges and penalties, so the risk is not worth taking.

Conclusion

Have you already found your answer to “Can I claim laptop repair on my taxes?”.

A laptop or notebook is a depreciable asset with a useful life of three years if used for business. After the first year of ownership, you may be eligible for a deduction for the drop in value. The amount you may claim depends on how often your laptop is used for business.

Therefore, you need not worry about depreciation if you want to file a claim for repairs on a personal laptop broken down due to normal wear and tear. This repair does not impact your laptop’s structure (or performance) as other types do.

Tax laws are frequently revised. Always contact a tax expert for the most up-to-date information. This material is not meant to provide tax advice and is not a replacement for professional tax counsel.

You can also read: Is Laptop Service necessary? Benefits Of Laptop Servicing